Accounting by Guesty is a premium feature. Please contact us to discuss activating it.

The business model setup is the basis for Accounting by Guesty.

Create one or more business models to define how each charge or expense is calculated and shared between your business, the owner, or vendor. Before proceeding, learn more in our business model overview article and video, and review our checklist for onboarding to Accounting.

Before you begin

Before proceeding make sure your Guesty account setup is complete, as detailed in Preparing for Accounting onboarding.

Important:

If you do not have at least one additional fee or a tax added in Guesty, an error will occur when you try to create a business model.

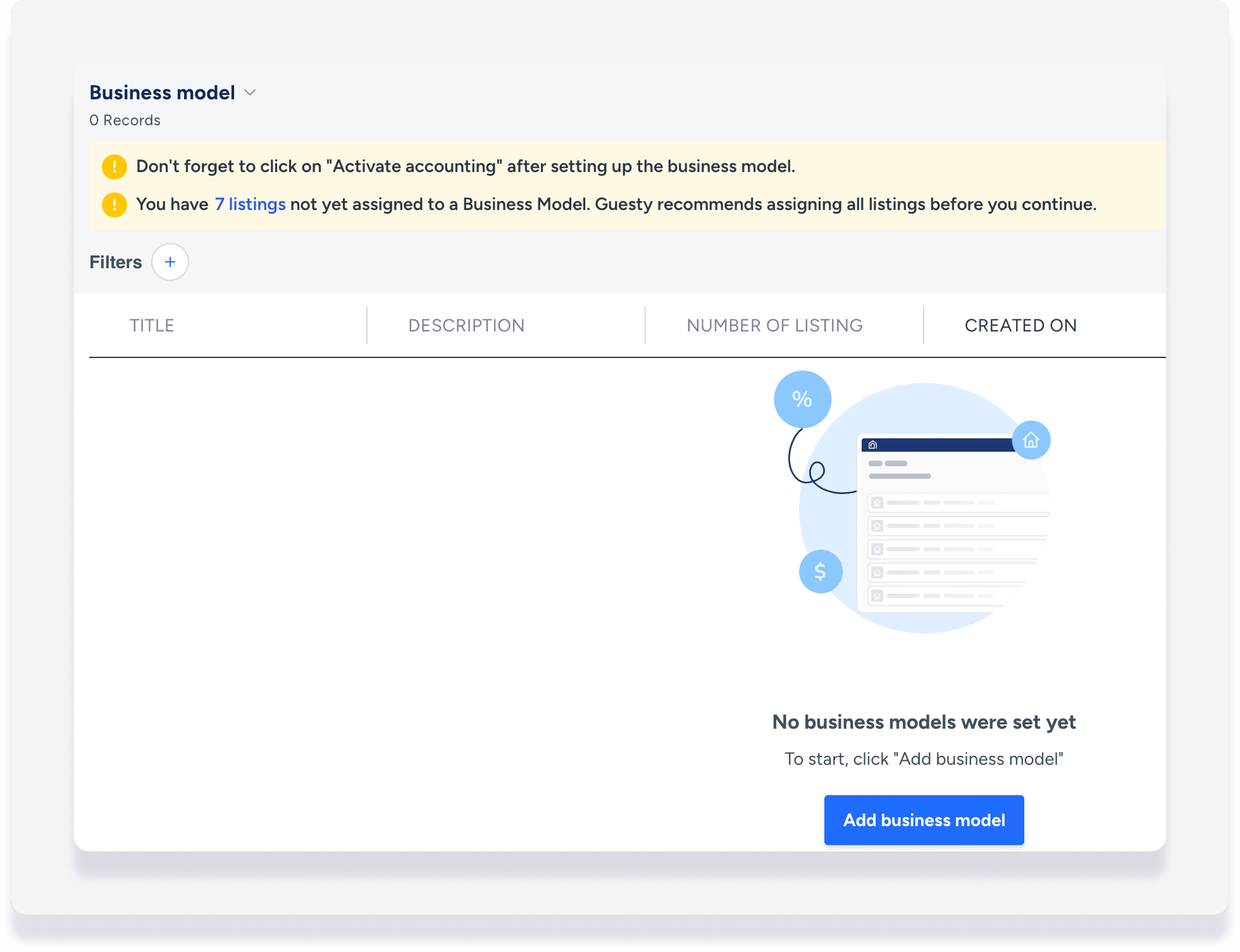

Create your first business model and activate Accounting

Step by step:

- Sign in to your Guesty account.

- In the top navigation bar, click the mode selector and select Accounting mode.

- Click Business models.

- Click Add business model.

- Fill in the business model fields. Learn more below.

- At the top right, click Create business model.

- At the top right of the business model page, click Activate Accounting.

- In the pop-up, select the entry trigger, or recognition date, for each income and expense in your business models:

- Check-in: The transaction will be recognized upon check-in, even if the guest paid before the check-in date

- Check-out: The transaction will be recognized upon check-out, even if the guest paid before the check-out date

- Nightly: The transaction will be recognized on a nightly basis, with a journal entry created for each night separately. For example, if a reservation runs from 25 May until 5 June, the transaction will be recognized for each night even though they are in two different months. Learn more.

The entry triggers you selected will be the default revenue recognition date in every business model you create after activating Accounting. You can change this in each business model as needed.

Create a new business model

Step by step:

- Sign in to your Guesty account.

- In the top navigation bar, click the mode selector and select Accounting mode.

- Click Business models.

- At the top right, click Add business model.

- Fill in the business model fields. Learn more below.

- At the top right, click Save.

After a business model is created it can be edited, updated, and saved as a new version. Learn more.

Create a business model based on an existing model

If you'd like to create a new business model with settings similar to an existing one, follow these steps.

Step by step:

- Sign in to your Guesty account.

- In the top navigation bar, click the mode selector and select Accounting mode.

- Click Business models.

- Click the business model you'd like to copy to open the settings.

- Enter a new name and edit the settings as needed for the new business model.

- At the top right, click Save as new.

The "Save as new" button appears as soon as you make an edit.

Business model fields explained

Note:

Airbnb resolution center (ARC) items cannot be included in your net rental income calculation. As a workaround you can adjust this line item in the guest folio on a per-reservation basis.

Name

Create the business model's internal name. It will only be used in Guesty to help you identify the model and is not visible to guests.

Activation date

This is the date on which the business model will become active and apply to the listings assigned to it. The activation date defaults to the creation date, however you can change it to be in the past or in the future.

For example, if there are upcoming changes in the revenue share agreement with your owner, create a business model with a future date, and assign the listing to it. The changes will apply from the activation date.

Journal entries and activation dates

Guesty uses the activation date to determine when to generate journal entries for reservations. The system compares the reservation's check-in date to the business model's activation date:

- Check-in is on or after the activation date: Guesty creates the relevant journal entries

- Check-in is before the activation date: Guesty doesn't create journal entries for the reservation

Description

Provide a short explanation of the business model, to help you find it quickly when needed.

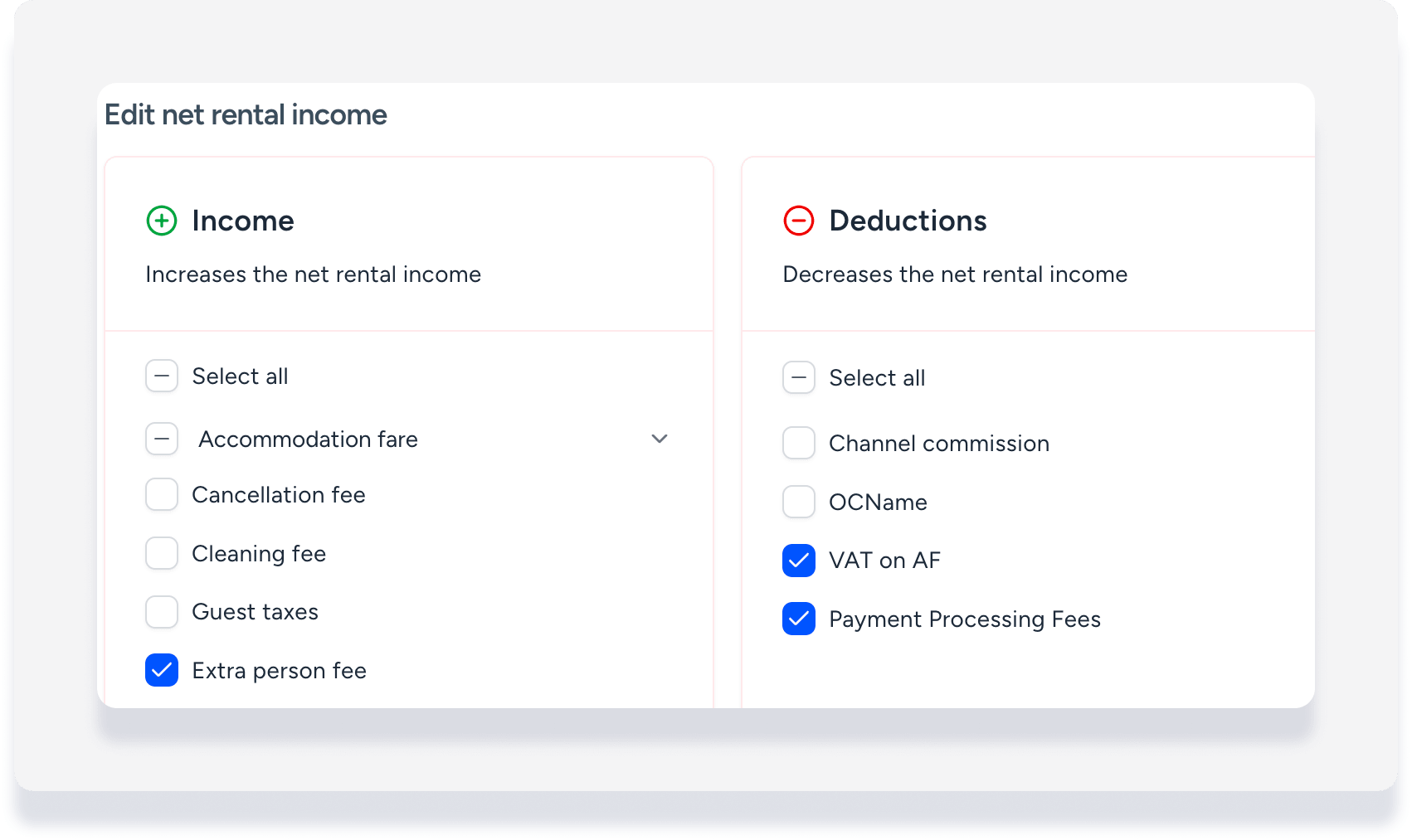

PMC Commission - Net rental income (NRI) calculation

Your commission is calculated from the net rental income (NRI). The default for NRI is accommodation fare only. Select fees and expenses to adjust the calculation and accurately reflect your existing accounting setup.

- Income - Added to and increases NRI

- Deductions - Subtracted from and decreases NRI

Learn more about setting the net rental income calculation, including pilot features and limitations.

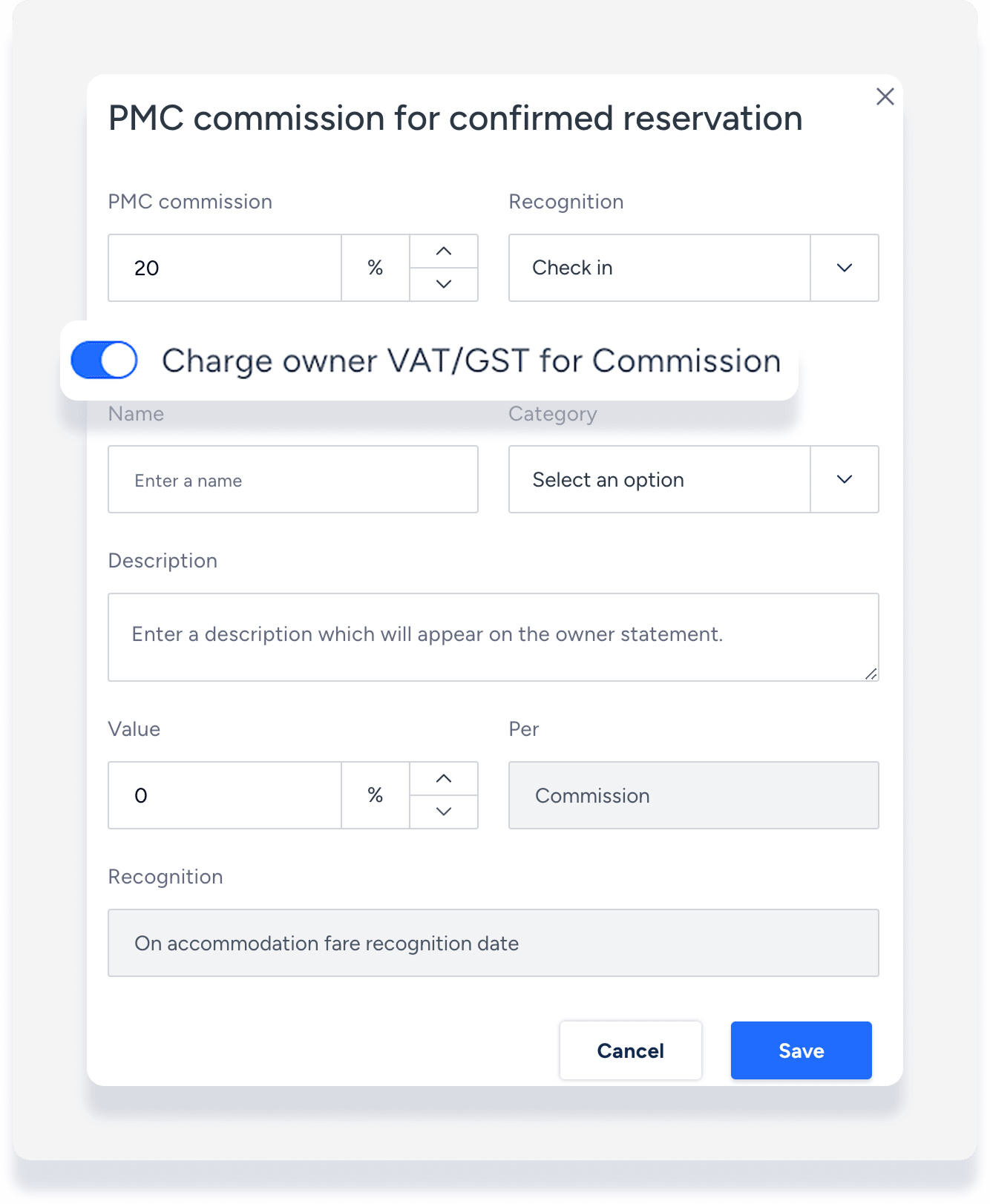

Commission setup

Set the PMC commission out of the NRI:

Confirmed reservations: Click edit to set the commission amount and the recognition. Recognition defines the date the transaction should be recognized in your accounting, and applies to both confirmed and canceled reservations.

Canceled reservation: Click edit to set the commission amount.

This commission applies to reservations that are canceled after check-in. For reservations canceled prior to check-in, a cancellation fee is applied based on the listing's cancellation policy. The commission split between PMC and owner for the cancellation fee is set under "Trust account income" below.

Optional for both reservation types:

- Toggle on Charge owner VAT or GST for Commission. Fill in the details then click Save.

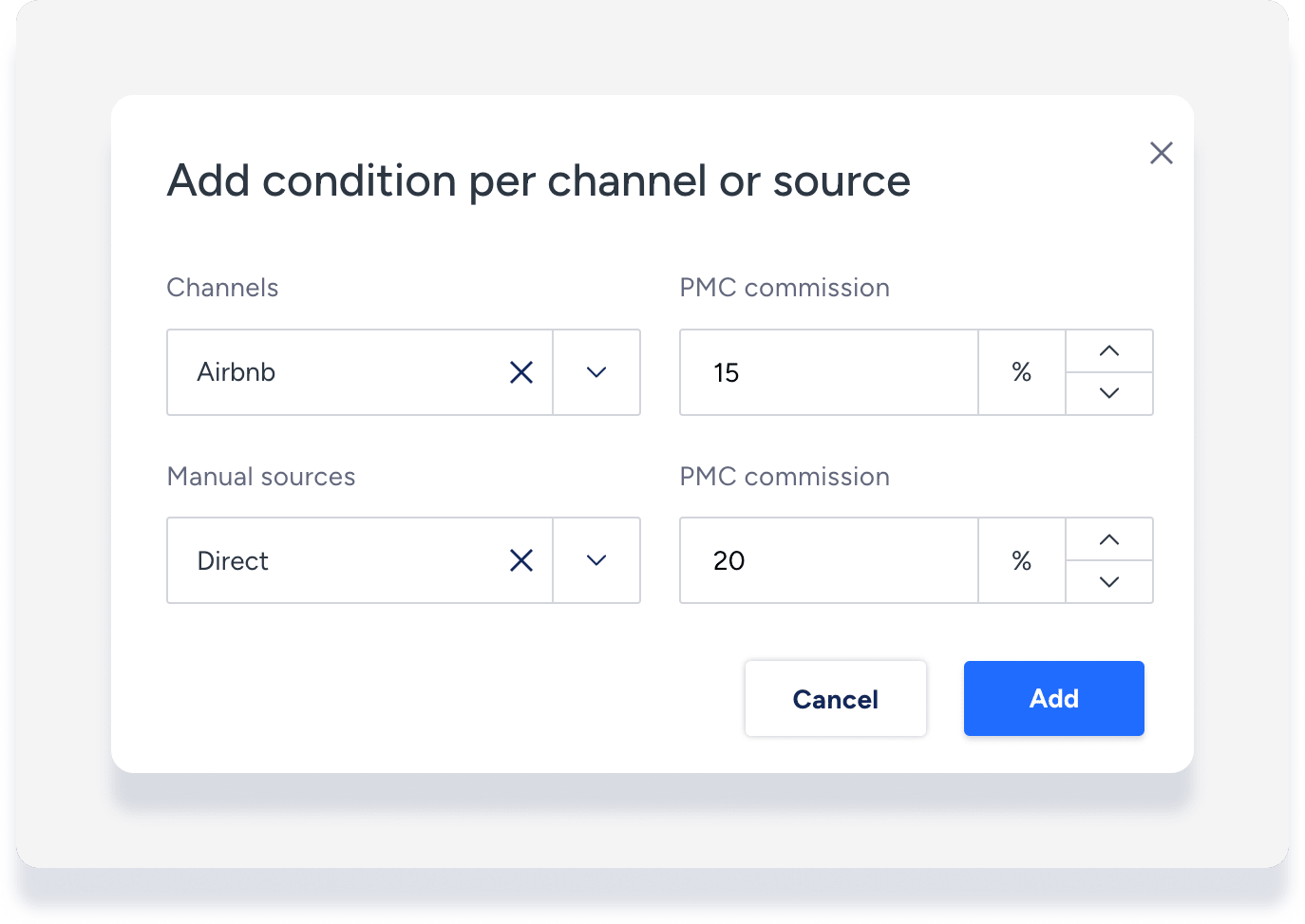

- Click Add condition per channel or source to set specific commissions for connected booking channels or for other sources like a direct booking website.

Minimum commission: Click Set minimum commission to ensure that you don’t make under a certain amount per reservation. If the percentage commission is more than the minimum you will receive the higher amount. Learn more.

Note that if you set a minimum commission amount, you cannot include percentage expenses in your NRI.

Trust account income

Add recurring owner charge

Create a recurring charge for a charge that occurs repeatedly. After creating a name for the owner charge, choose the relevant category, write a description of the charge, enter an amount, and choose how often the charge should occur, e.g. per stay, per guest, per quarter, etc.

Select the recognition, which defines the date the transaction should be recognized in your accounting.

Set the revenue share between the PMC and the owner/vendor. Choose the conditions for this expense and what manual reservations or channel reservations the conditions will apply to.

An example of a recurring owner charge could be a monthly marketing fee that is split 50%-50%.

Cancellation fee

Choose how to split the payment for a cancellation fee between the PMC and the owner. This applies to reservations that are canceled prior to check-in, based on the listing's cancellation policy.

For reservations canceled after check-in, see "Commission setup" above.

Cleaning fee

Choose how to split the payment for a reservation's cleaning fee between the PMC and the owner/vendor, for confirmed and canceled reservations.

The split can be based on percentages, such that you always get X percent of the fee and the owner/vendor gets 100-X percent of the fee, or you can decide that you will always get a fixed amount out of the fee, and make sure that the rest of the fee is paid to the owner/vendor.

Guest taxes

Choose whether the owner or the PMC is responsible to remit the taxes to the relevant tax authorities.

Note:

For the guest folio tax per line item breakdown, currently in beta, revenue is recognized differently for flat fee taxes and for percentage taxes that are applied to specific line items. Learn more.

Extra person fee

Choose how to split the revenue between the PMC and the owner/vendor, and the recognition date.

Weekly discount

Choose how to split the revenue between the PMC and the owner/vendor, and the recognition date.

Markup/markdown on accommodation fare

Choose how to split the revenue between the PMC and the owner/vendor, and the recognition date.

Additional fees

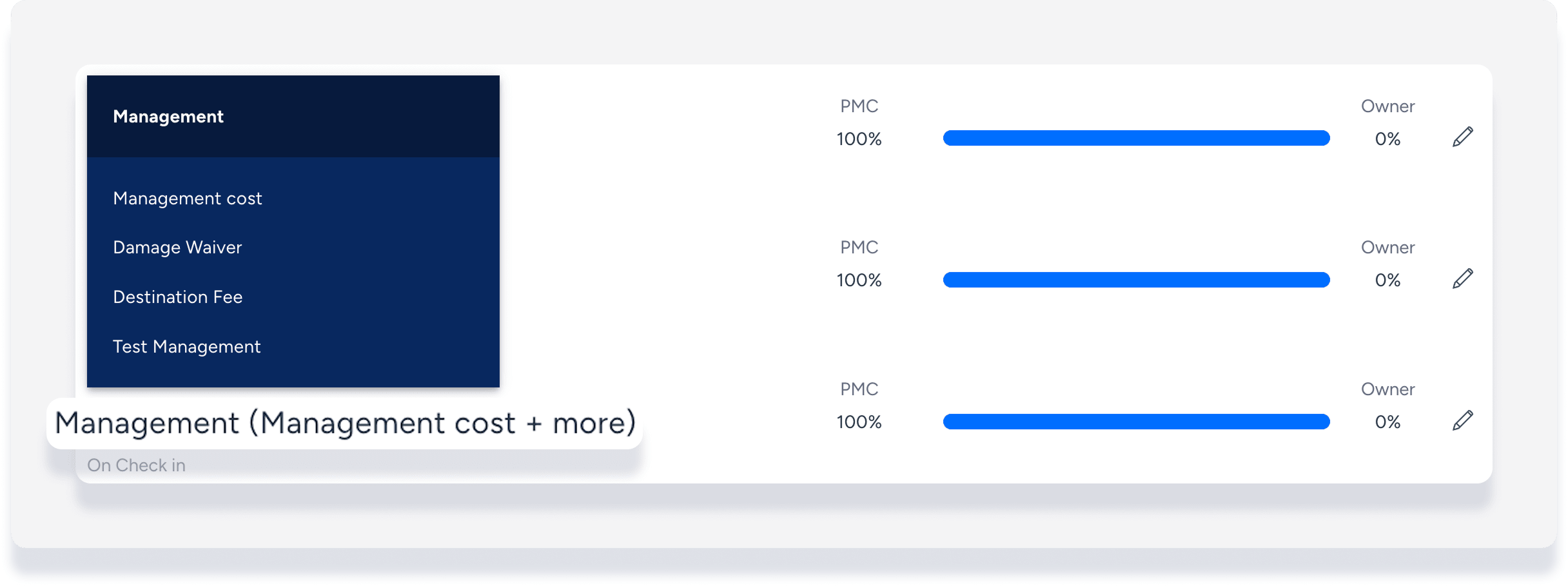

For each additional fee, choose how to split the payment between the PMC and the owner/vendor, and the recognition date.

Additional fees are displayed as the fee type, with the fee name shown in parentheses. If the fee name has been edited, hover over the fee type/name to see the historical names in a pop-up.

In the example below, fee type "Management" is currently named "Management cost". "+ more" indicates that different fee names were used in the past, and these can be seen in the pop-up.

Trust account expenses

Add recurring expense

Add a recurring expense for a cost that occurs regularly. After creating a name for the expense, choose the relevant category, write a description of the expense, enter an amount, and choose how often the charge should occur, e.g. per stay, per guest, per quarter, etc.

Select the recognition, which defines when the transaction should be recognized in your accounting.

Set the charge share between the PMC and the owner. For example, if you want to charge an owner entirely for the recurring expense, set the owner charge share field to 100%.

Choose the conditions for this expense and what manual reservations or channel reservations the conditions will apply to.

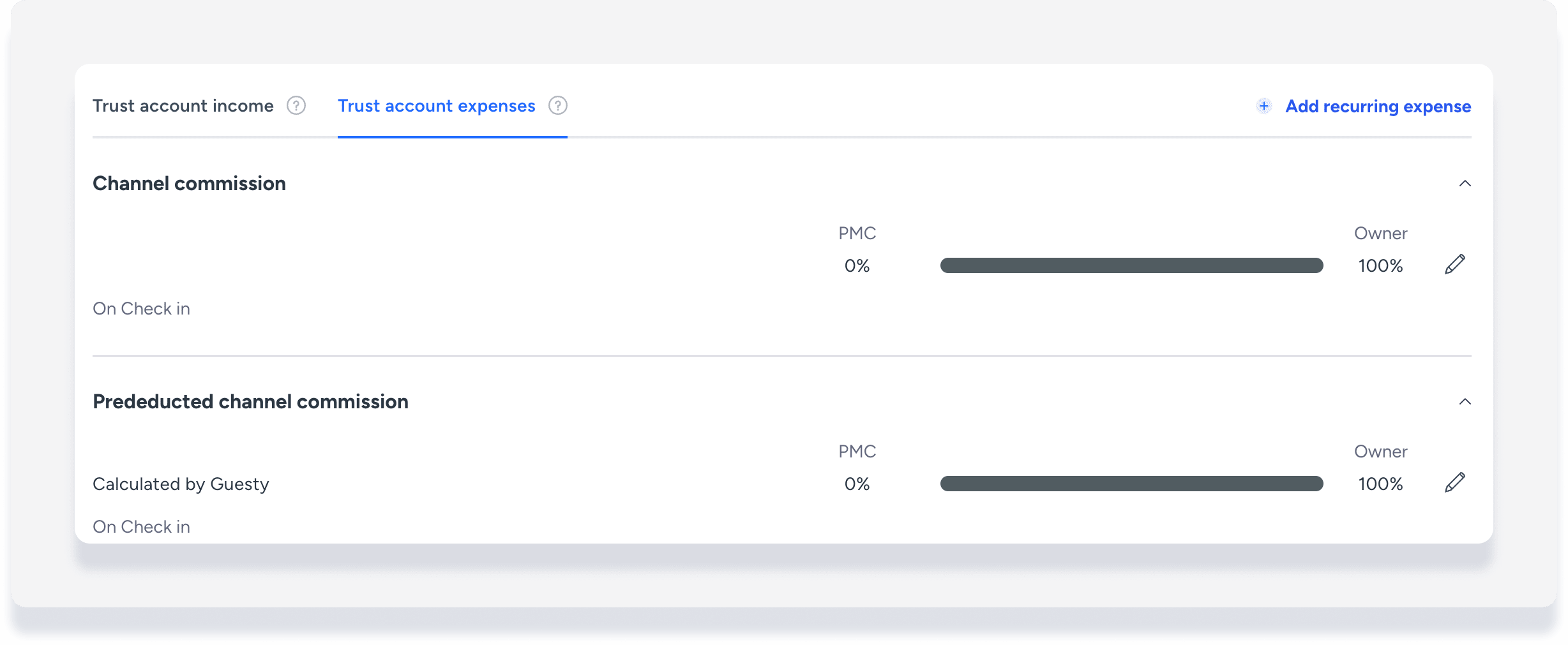

Channel commission

Choose when to recognize and how to split the payment between the PMC and the owner for booking channel commissions, based on your setup in Guesty. (If you are on cash basis accounting, the channel commission is always recognized at check-in.)

You have the option to set a different split for pre-deducted commission, or keep them both the same. Learn more about the two types.

Note:

A recurring expense is paid from the trust account, not the operational account of the PMC.

Next steps

- Assign listings to your business model

Follow the steps here to assign listings to your business model.

- Verify business model calculations

Once you have a reservation processed by a business model, check that all four sections of the accounting folio were calculated accordingly.