Guesty provides a detailed breakdown of channel commissions, separating the net commission from taxes like GST or VAT. This visibility ensures your accounting remains compliant and matches the invoices you receive from channels like Booking.com or Airbnb.

This feature allows you to configure tax rates for specific channels at either the account or listing level. Once set up, view these line items directly in the guest folio and accounting folio for all new reservations. The data is also visible in Accounting reports.

Understanding the breakdown logic

Guesty uses a specific hierarchy to display commission data:

Channel-provided values: For Airbnb, Guesty pulls the actual net, tax, and total values directly from the channel.

User-configured settings: For all other channels that don't provide a breakdown, Guesty uses the tax rates you define in your financial settings.

Default values: If no configuration exists, the tax amount defaults to zero.

Important:

This breakdown is only available for new reservations confirmed after this feature is enabled.

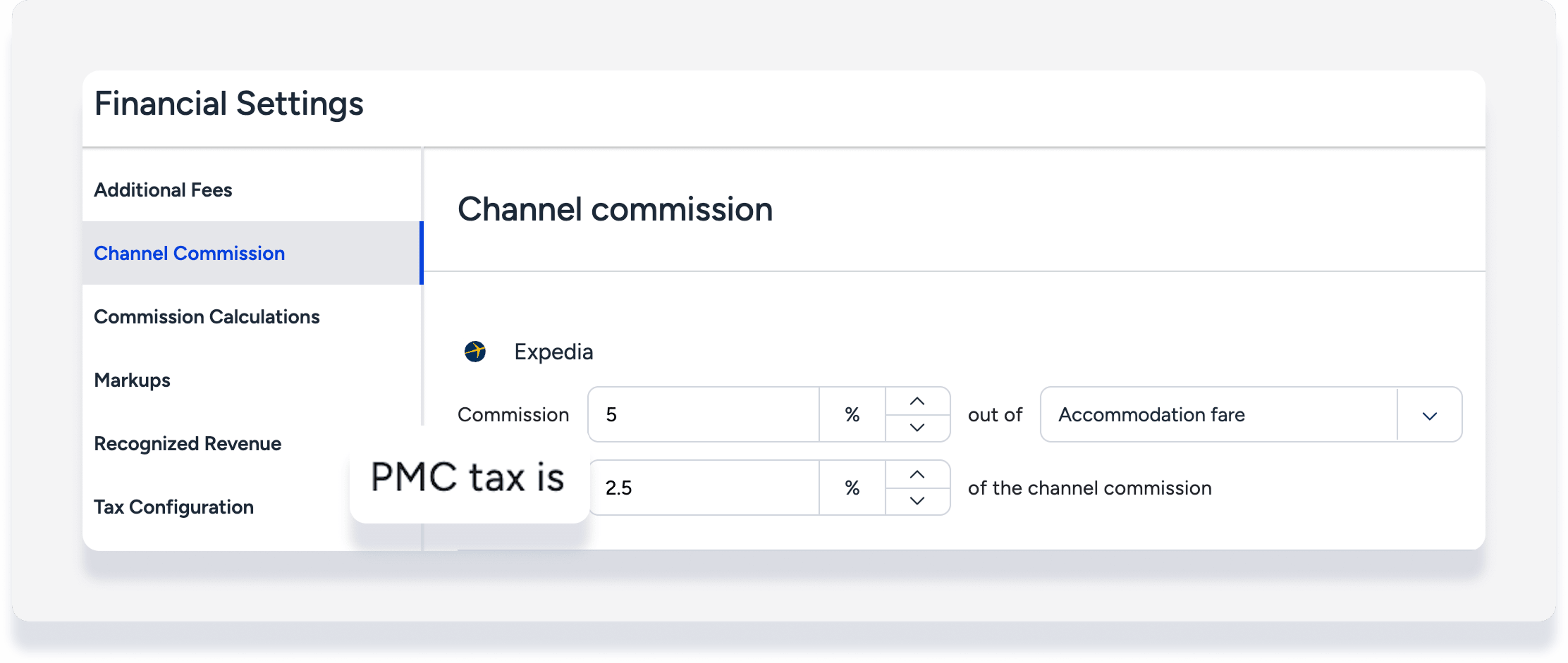

Configure channel commission taxes

Step by step:

Access your channel commission settings on the account or listing level.

At the top-right, click Edit.

Locate the specific channel to update.

-

In the "PMC tax is" field, enter the applicable tax percentage.

- At the top-right, click Save.

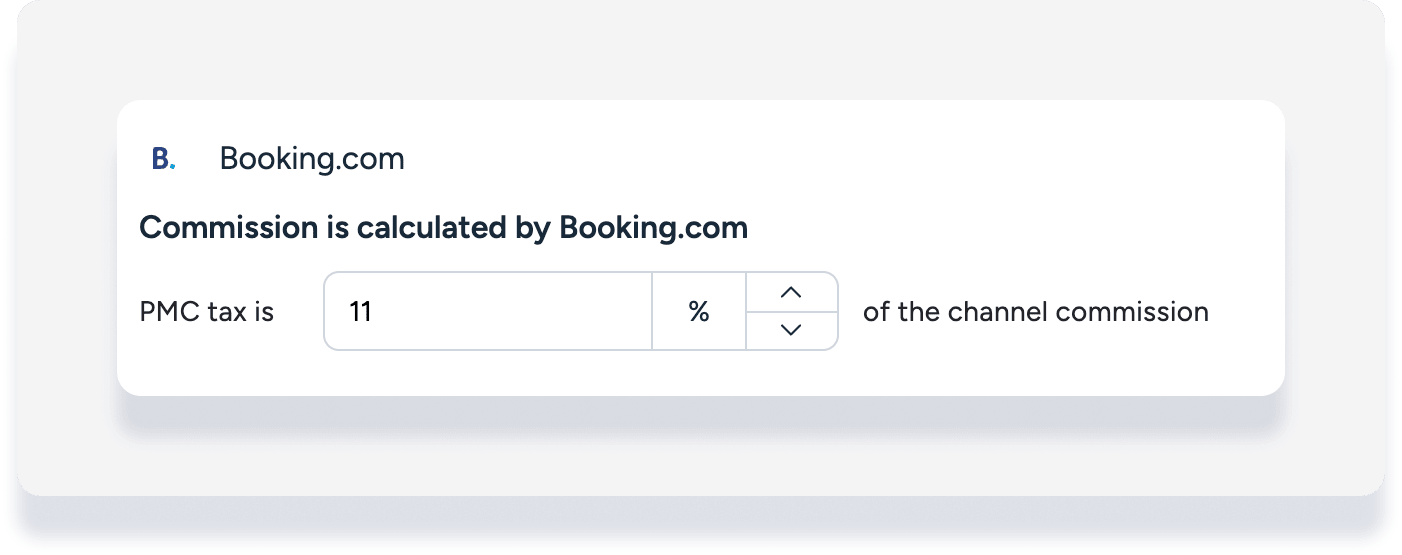

Commission calculated by channel

Where "Commission calculated by channel" is indicated, for example Booking.com, you can still set the PMC tax. This is calculated on the commission amount sent by the channel and broken down in financial data. Learn more about different commission types.

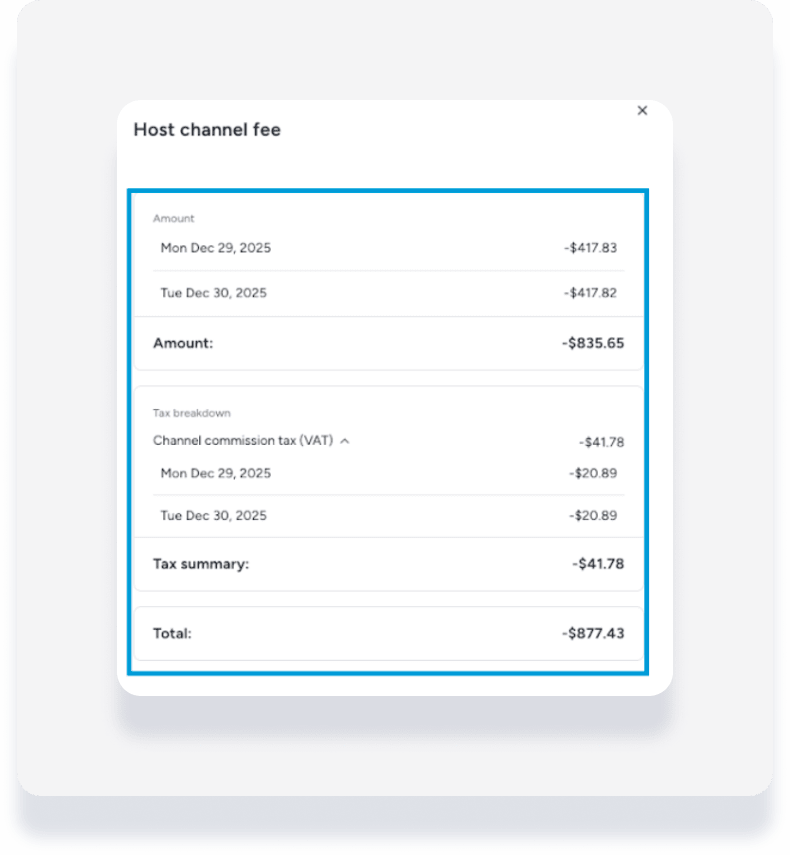

View commission data in a reservation

Once configured, review the specific costs associated with each new booking. Follow the steps below to view the commission breakdown in a reservation's guest folio and accounting folio.

Step by step:

Access a reservation's guest folio.

Click Host channel fee.

-

In the side panel that opens, view the breakdown details.

Net Channel Commission: Base commission before taxes

Tax amount: Calculated GST or VAT

-

Gross channel commission: Total amount (Net + Taxes)

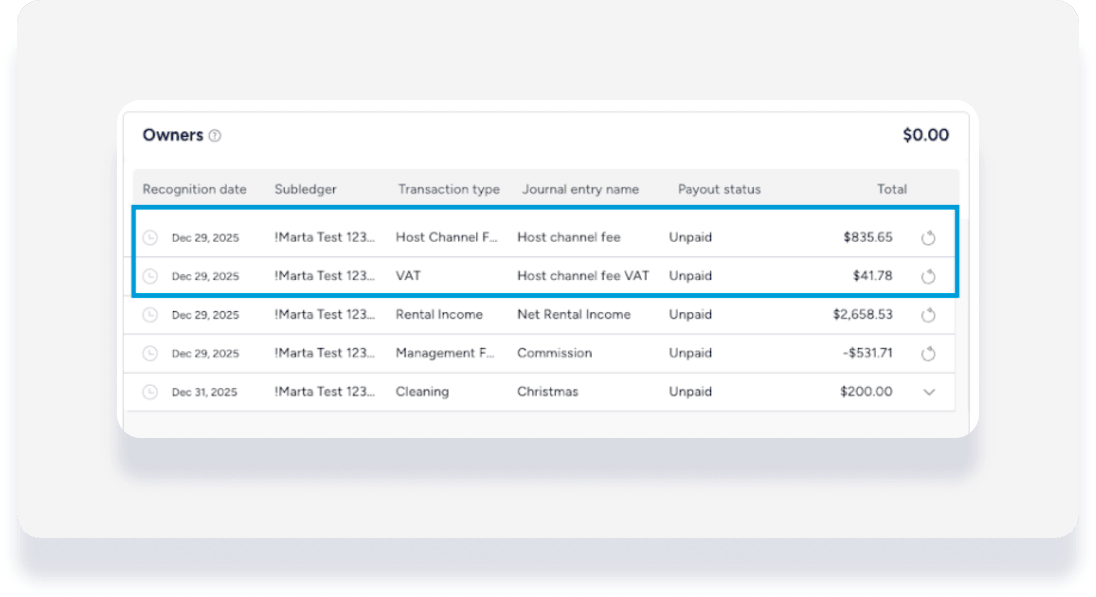

Accounting users

For every reservation confirmed after the feature is enabled, Guesty automates the following:

Separate journal entries: One entry for the net channel commission and a second entry for the commission tax.

Automatic reversals: If you reverse a channel commission, Guesty automatically reverses the related tax journal entry to maintain balanced books.

Ledger visibility: View the net commission and commission tax as separate line items in a reservation's accounting folio: